Paycheck calculator with exemptions

In a few easy steps you can create your own paystubs and have them sent to your email. Payroll Deductions Calculator W-4 with Exemptions.

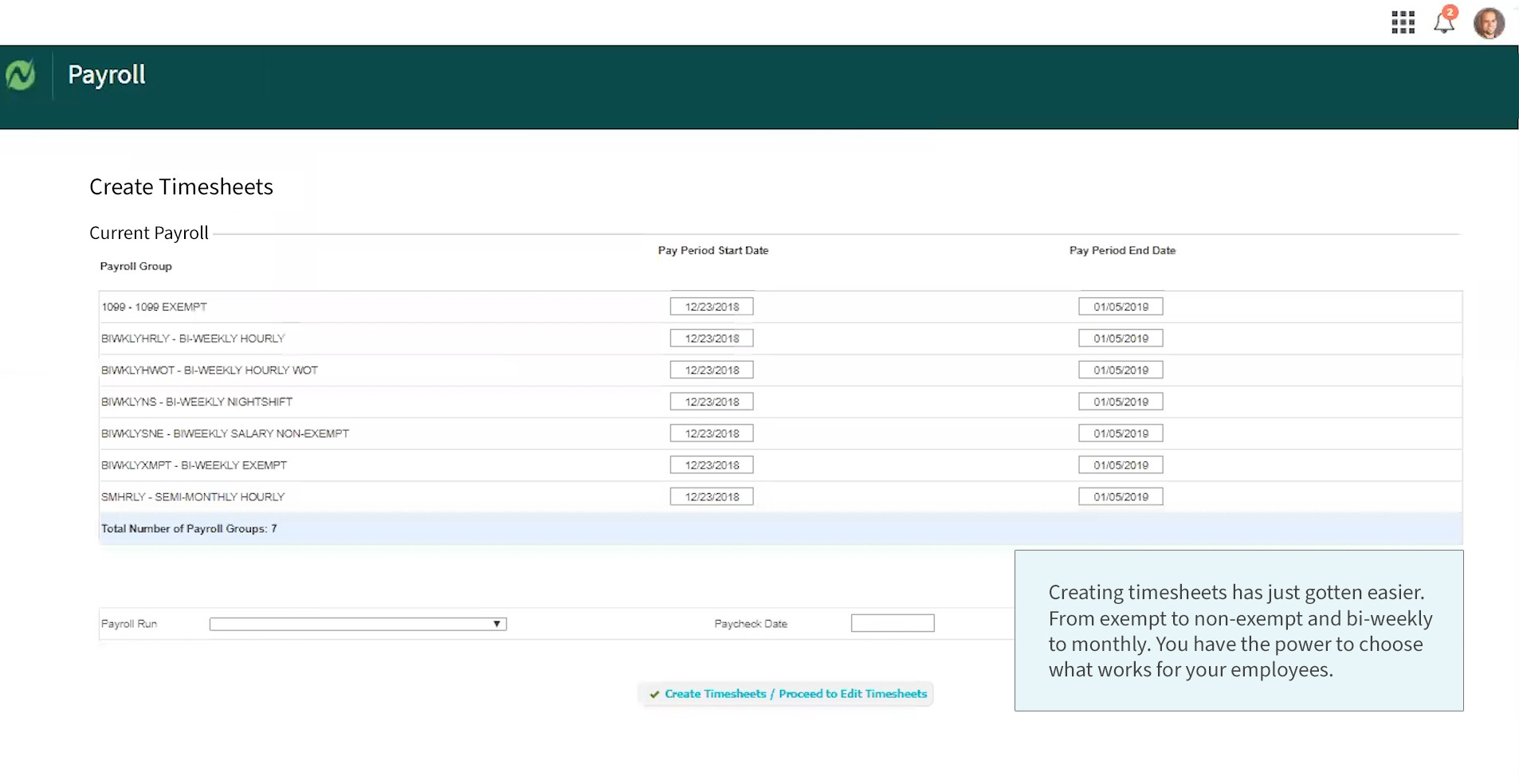

Paycheck Calculator Netchex Payroll Software

Adjusted gross income - Post-tax deductions Exemptions Taxable income.

. That result is the tax withholding amount you. Use our W-4 calculator. Use this simplified payroll deductions calculator to help you determine your net paycheck.

PERS ADJ PERSREDPST or STRS REDST on your earnings. Estimate your federal income tax withholding. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Enter E in the federal marital status field to claim exemption from federal tax withholding. This calculator uses the old W-4 created before the Tax Cuts and. How to calculate annual income.

See how your refund take-home pay or tax due are affected by withholding amount. So the tax year 2022 will start from July 01 2021 to June 30 2022. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication.

Your employer withholds a 62 Social Security tax and a. It can also be used to help fill steps 3 and 4 of a W-4 form. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees.

For example if an employee earns 1500. Make Your Payroll Effortless and Focus on What really Matters. By accurately inputting federal withholdings allowances and any relevant.

Work out your adjusted gross. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. It can also be used to help fill steps 3 and 4 of a W-4 form.

The calculators allow employees to calculate paychecks for monthly semi-monthly and bi-weekly in one place which also can be used for out-of-state employees with no state taxes input 99. 250 minus 200 50. Use this tool to.

All Services Backed by Tax Guarantee. Ad Payroll So Easy You Can Set It Up Run It Yourself. Free 2022 Employee Payroll Deductions Calculator W-4 with Exemptions Use this calculator to help you determine the your net paycheck.

Then look at your last paychecks tax withholding amount eg. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. We use the most recent and accurate information.

One of the most useful and sought after this paycheck calculator quantifies take-home pay for salaried employees. Updated for your 2021-2022 taxes simply enter your tax information and adjust your withholding to understand. Figure out which withholdings work.

Arkansas tax year starts from July 01 the year before to June 30 the current year. Use this calculator to help you determine the your net paycheck. Your W-4 impacts how much money you receive in every paycheck your potential tax refund and it can be changed anytime.

This calculator uses the old W-4 created before. 250 and subtract the refund adjust amount from that. Ad Compare 5 Best Payroll Services Find the Best Rates.

When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. Estimate your paycheck withholding with our free W-4 Withholding Calculator. Taxable income Tax rate based on filing status Tax liability.

Heres a step-by-step guide to walk. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Ad Create professional looking paystubs.

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Free Paycheck Calculator Hourly Salary Usa Dremployee

Paycheck Calculator Online For Per Pay Period Create W 4

How To Calculate Net Pay Step By Step Example

Paycheck Calculator Salaried Employees Primepay

Free Paycheck Calculator Hourly Salary Usa Dremployee

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

Illinois Paycheck Calculator Smartasset

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

Free Paycheck Calculator Hourly Salary Usa Dremployee

Calculating Federal Taxes And Take Home Pay Video Khan Academy

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

Free 6 Sample Net Pay Calculator Templates In Pdf Excel

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

Oklahoma Paycheck Calculator Smartasset